Survey reveals women entrepreneurs want to develop their digital skills and take their businesses international

Results of recent research in Eastern and Southeastern Europe, Central Asia and the Caucasus – conducted by Emerging Europe as part of the She’s Next Empowered by Visa campaign – show female leaders in the region have a keen interest in digital marketing and social media and are willing to take their businesses international.

London, March 1, 2023 – Visa today announced the results of research into female leadership and entrepreneurship in Eastern and Southeastern Europe, Central Asia and the Caucasus conducted by Emerging Europe, a prominent growth hub with expertise in the region, as part of the She’s Next initiative.

The extensive study comprised an online survey of 2,000 business owners or self-employed women in 11 countries, 75 in-depth interviews and focus groups. The findings provide a thorough profile of the average female entrepreneur from the region and will allow stakeholders to understand the struggles and challenges faced by women as they pursue their careers.

“As one of our interviewees said, it is harder for women to raise funds. It is harder in Silicon Valley. It is harder in her country of Armenia. And raising funds is only one of the multiple challenges that female entrepreneurs are facing,” said Andrew Wrobel, Founding Partner of Emerging Europe.

“In this research, we wanted to explore female entrepreneurship as deep as possible and understand all potential obstacles that might influence the businesses and start-ups women create. We also wanted to explore their needs, as well as potential solutions that could empower them and help their businesses thrive and grow internationally.”

Overall, most women-owned businesses in Eastern and Southeastern Europe, Central Asia and the Caucasus (84 per cent) don’t cross international borders, but female entrepreneurs are willing to learn about doing business abroad.

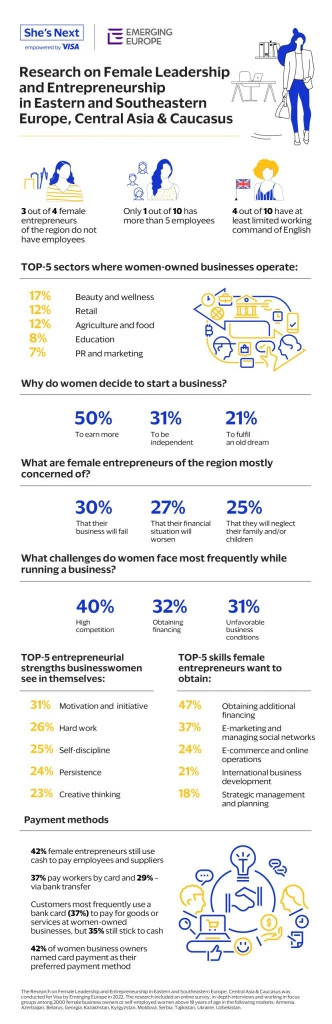

The leading sectors where women-owned businesses operate are beauty and wellness (17 per cent), retail (12 per cent), agriculture and food (12 per cent), education (eight per cent) and PR and marketing (seven per cent). Two-thirds of female entrepreneurs do not use external financing, while three-quarters do not have any employees. Some 35 per cent of women-owned businesses in the region were set up with an investment of less than 1,000 US dollars. Only one in 10 women employs more than 5 people.

“From its start in 2019, the She’s Next programme was all about empowering female leaders and local communities and helping them thrive,” said Vira Platonova, Visa Senior Vice President and Group Country Manager for 17 countries.

“That is why it is very important for Visa to learn about the specific needs and concerns of women entrepreneurs in the countries where the initiative is active. We are happy to see female leaders of Eastern and Southeastern Europe, Central Asia and the Caucasus gradually transition to e-commerce and enjoy convenient and reliable digital payments. We will use the results of the research to bring many more initiatives promoting gender inclusivity in the region.”

Key takeaways

Women strive for professional and financial independence. The main sources of motivation for women to start their businesses are a desire to increase income (50 per cent), willingness to work for themselves (31 per cent) and fulfilment of a dream (21 per cent).

Female entrepreneurs care about their business and private lives almost equally. Respondents named business failure (29 per cent), a worsening financial situation (27 per cent) and neglect of family and children (25 per cent) among their biggest concerns.

Women-owned businesses struggle to survive competition and raise funding. Female entrepreneurs tend to face such challenges as high competition (40 per cent), raising capital (32 per cent), and unfavourable business conditions (31 per cent).

Female entrepreneurs want to learn about doing business online. The primary skills that respondents are willing to obtain are strategies to acquire additional funding (47 per cent), digital marketing and social media (37 per cent), e-commerce (24 per cent) and international business development (21 per cent).

Women-owned businesses stick to cash when paying employees and suppliers but tend to install POS terminals for customers. 42 per cent of female entrepreneurs pay their employees and suppliers in cash, while 37 per cent prefer card payments. When it comes to customers, electronic payments are far more popular: 37 per cent of respondents named card payments the most frequent method to pay for their goods and services and 42 per cent said they prefer their customers to pay them by card. In comparison, 35 per cent of female entrepreneurs said their customers paid in cash more often, and only 28 per cent prefer clients to stick to cash.

The next stage of the Visa and Emerging Europe partnership — which has the ambitious goal of uniting female entrepreneurs throughout the region within the She’s Next community — is to provide them with a platform to communicate, mentor, exchange experiences, and expand the horizons of their businesses.

New Free Courses — Made for Ambitious Women Entrepreneurs!

It’s time to grow smarter, adapt faster, and take your business global.

Explore two powerful courses available exclusively to She’s Next members:

The Reinvention Masterclass for Start-up Founders

Beyond Borders: Building for Global Success

Enroll today — it’s free!

Responses