From Columbia to Fintech: Mariam Rusishvili’s journey of innovation and impact

Mariam Rusishvili’s inspirational career, spanning public and private sectors, has culminated in her role as CEO and co-founder of LightSpeed Digital, (ex-QuickCashAI) a groundbreaking Georgian fintech start-up.

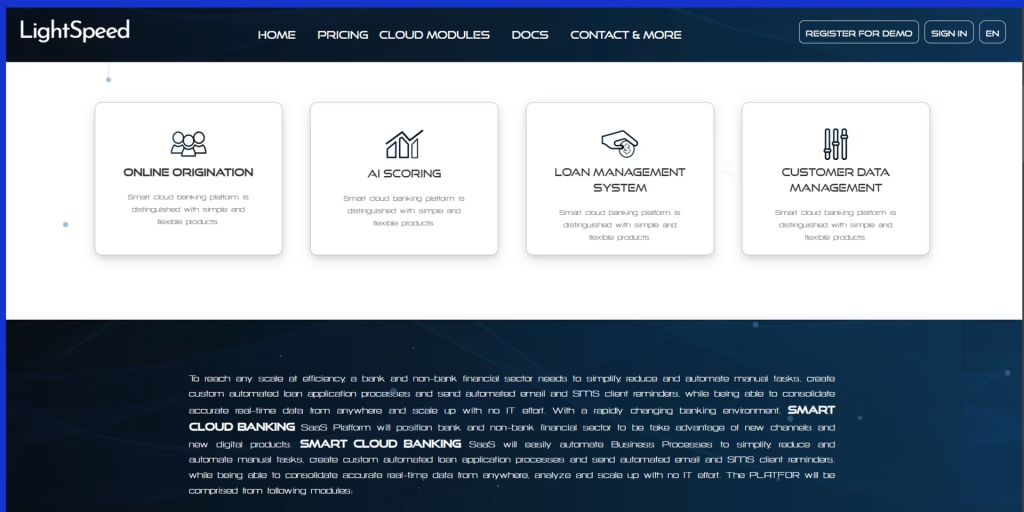

Mariam Rusishvili has packed a great deal into her career so far. A graduate of Columbia University in New York, she has worked in both the public and private sectors, as well as at international organisations such as the World Bank. Today, she is the CEO and co-founder of Georgian fintech platform and consulting LightSpeed Digital, a smart cloud SaaS platform that simplifies scoring and underwriting procedures (such as loan applications) for firms operating in the financial sector – both banks and non-banks.

Her time at Columbia, she admits, was “pivotal” to her career.

“I did my masters in economic policy management, and was fortunate enough to be taught by two Nobel Prize laureates. It was quite the journey for me, and equally important were the amazing people I was studying with. People from diverse places and backgrounds, all with different experiences. Some already had their own firms, others came from central banks, public investment funds. It opened a new world for me.”

Fintech, she adds, was not on her agenda at the time. “It was still in its infancy, certainly in Georgia.”

After graduating, Rusishvili took up a post at the World Bank. “That gave me a real understanding of how the economy works, and that we were missing so many things in Georgia in 2011 – things as simple as Groupon, and e-commerce in general. It made me wonder why we these kinds of businesses didn’t operate in Georgia.”

After leaving the World Bank Rusishvili worked at an investment fund in Washington, active across the emerging markets. “That’s where I learnt how private equity works,” she says. She then returned to Georgia and was a key player in the creation of Enterprise Georgia, which promotes an entrepreneurial culture throughout the country by stimulating the establishment of new enterprises and supporting the expansion of existing operations through various instruments of access to finance.

Access to capital

Rusishvili was also deputy CEO of the Georgia Energy Development Fund, where she contributed to creation of the first wind farm in the region, that was successfully sold to IFI. She says that she is proud that both Enterprise Georgia and the Georgia Energy Development Fund are still operating, “contributing to the economic development of the country.”

Moving back into the private sector with a role at TBC Bank, Rusishvili says that she was able to identify one of the key problems facing entrepreneurs and SMEs in Georgia: access to capital and no automation of credit processing.

“The rejection rate for small businesses was high,” she recalls. And from there came the idea for LightSpeed Digital, which created scoring algorithms to ease the finance application process that could help banks better identify those kinds of businesses worth investing in.

The fintech has been enormously successful, winning awards for its innovative products and creating a consultancy arm, working with organisations such as the Georgian government, and Asian Development Bank on pension reform and capital market development strategy.

She also works with the International Finance Corporation (IFC) to assist in its endeavours to make Georgia a fintech hub for the so-called Middle Corridor, a trade route from Southeast Asia and China to Europe via Kazakhstan, Caspian Sea, Azerbaijan, Georgia and Turkey.

‘Where are the men?’

Working in a field that continues to be dominated by men, Rusishvili admits that there have been times when being a woman has made life difficult. But she admits that she loves challenges, it creates drive.

“I remember once being at a meeting in Kazakhstan, and I was asked, ‘Where are the men?’,” she remembers.

She also recognises that raising capital can be particularly difficult for women.

“When you are a first-time founder, even if you have built an amazing team, and amazing product, and you have amazing experience, everything for first-time women founders – especially coming from this part of the world – is difficult. I think it’s changing now – and that’s partly because this part of the world is increasingly prominent on the radar of investors.”

Nurturing networks

As with so many successful entreprenuers, Rusishvili is keen to highlight the importance of networking. But she is equally adamant that it’s not just about creating a network – a network needs to be nurtured, she believes.

“My network was a real help,” she says. “But no matter how big your network is, it is important to keep it active. You need to build longstanding relationships, and nurture them in the same way that you nurture your start-up.”

Circling back to her experience in the United States, Rusishvili says that she is convinced that in order to get the best view of something, you sometimes need to step away in order to view things from a new perspective.

“It’s great that it has become so normal for young Georgians to leave the country, at least for a while, to gain experience elsewhere, and then return. It offers a totally different perspective,” she says, admitting that it was during her time in the United States that she was able to see – from afar – some of the gaps in the Georgian market.

“Even if you work as a waiter, you are gaining practical experience. This is super important.”

The bigger picture

This feeds into Rusishvili’s final piece of advice for budding entrepreneurs: understand the bigger picture.

“It’s so important to understand the many different layers around a problem, the interconnected sectors,” she says. “Seeing the bigger picture helps connect the dots that could lead to a solution.”

It’s an approach, she adds, that can open the way to new opportunities, “because you might connect the dots and see something that others have not. If you look at things from a big picture perspective you can see all the components that need to be put together.”

New Free Courses — Made for Ambitious Women Entrepreneurs!

It’s time to grow smarter, adapt faster, and take your business global.

Explore two powerful courses available exclusively to She’s Next members:

The Reinvention Masterclass for Start-up Founders

Beyond Borders: Building for Global Success

Enroll today — it’s free!

Responses