Financing: Grants

For new entrepreneurs one of the most challenging aspects of being an entrepreneur is obtaining capital. It is not an easy task, especially in this modern business landscape where most entrepreneurs won’t be able to get started with the capital they have in hand, so in this article we will be discussing grants.

What are grants?

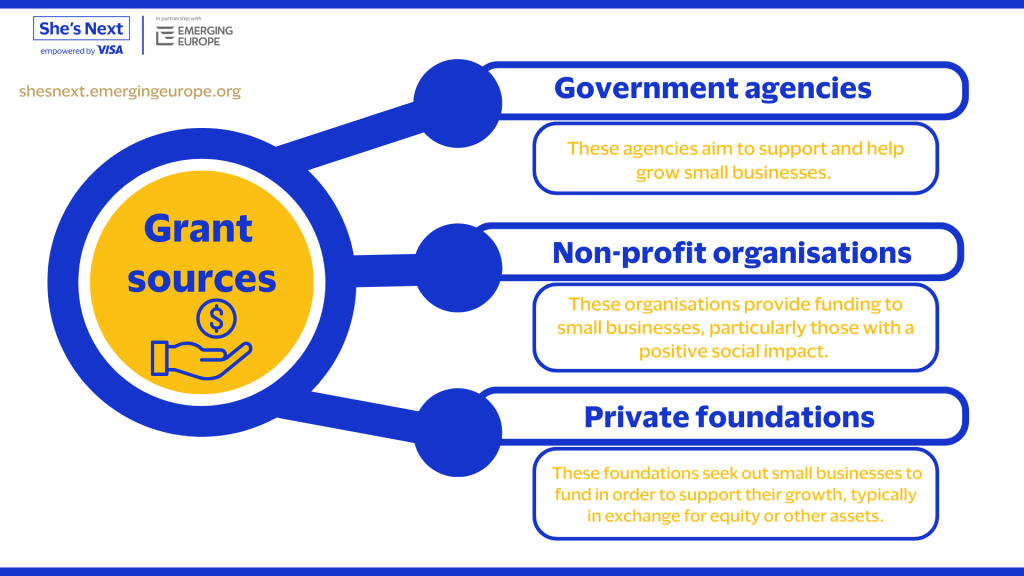

Grants are financial support given to a business by government agencies, private foundations, and other organisations in order to provide them with the funding they need to support their ventures. Grants are like a gift, rather than a loan where you are expected to pay back the money you gained, and with interest, grants allow you to keep that money for your businesses because they are non-repayable.

Benefits of grants

Like other forms of financial assistance, grants come with a multitude of benefits to help entrepreneurs grow in the initial stages of their business. Some of the main benefits that grants provide entrepreneurs are:

Start-up funds – Grants can serve as valuable seed capital to launch a new business without the stress of monthly loan payments, perfect for new entrepreneurs.

Risk Reduction – Grants can help mitigate the financial risks associated with entrepreneurship, as if you lose the money with a grant your credit rating and assets will not be in jeopardy like with a loan.

Increased status – Earning a grant can enhance the credibility of your business or project. It means that your idea or venture has been recognised and supported by a reputable organisation.

Responses